| IMPORTANT PLEASE READ: If Tax-Aid did not receive all of your tax documents by March 31, 2024, we will not be able to complete your tax return by the filing deadline. You will need to request an extension from the IRS here: https://www.irs.gov/forms-pubs/extension-of-time-to-file-your-tax-return. |

| An extension of time to file your return does not grant you any extension of time to pay your taxes. You should estimate and pay any owed taxes by your regular deadline to help avoid possible penalties. |

Tax-Aid offers free service to people that earn less than $64,000 a year.

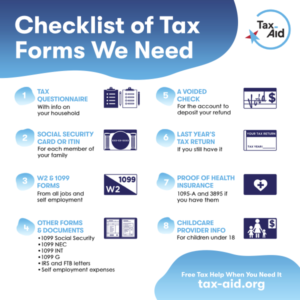

Tax-Aid is offering virtual tax services. That means you can email or mail us all of your tax documents and we will prepare your tax return for you. Everything will be sent back to you via dropbox, email or mail. If you want to email us your documents, you will either need a scanner or the camera on your phone or computer to take photos of your tax documents. Watch this short video to learn more about how Tax-Aid’s virtual service works:

If you earned more than $64,000 we will not be able to help you with your taxes.

Please follow these steps:

If you earned more than $64,000 we will not be able to help you with your taxes.

|

|